Otto Insurance: A Comprehensive Guide to the Modern Insurance Solution

In an increasingly digital world, consumers are looking for insurance companies that offer simplicity, transparency, and personalized service. Otto Insurance, a relatively new entrant into the insurance space, aims to provide just that. Known for its tech-driven approach, Otto Insurance combines innovation with customer-centric policies to stand out in a competitive industry. This article will take a closer look at Otto Insurance, its offerings, features, and the factors that make it unique.

What is Otto Insurance?

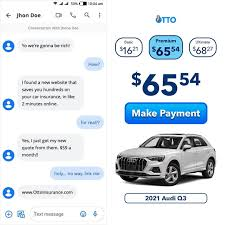

Otto Insurance is a digital-first insurance provider that focuses on providing consumers with accessible, easy-to-understand, and affordable insurance products. The company primarily operates through an online platform, allowing users to manage their policies, file claims, and access support entirely online. This approach eliminates the need for in-person meetings and long phone calls, making the process faster and more convenient for customers.

Founded with the goal of simplifying insurance and enhancing the customer experience, Otto Insurance aims to disrupt traditional insurance models by leveraging advanced technology. The company’s product offerings are designed to cater to a wide range of needs, from car insurance to homeowners’ insurance.

Key Features of Otto Insurance

1. User-Friendly Digital Platform

Otto Insurance uses its intuitive online platform to make managing your insurance straightforward. Customers can get quotes, adjust coverage, and even file claims—all from their computers or smartphones. The platform’s simplicity ensures that even those unfamiliar with insurance processes can easily navigate their policies.

2. Customizable Coverage Plans

One of Otto Insurance’s standout features is its flexibility. Customers can tailor their policies to fit their individual needs, adjusting coverage levels and selecting add-ons to enhance their protection. Whether you’re looking for basic car insurance or more comprehensive home insurance, Otto allows you to build the right plan for you.

3. Instant Quotes and Transparent Pricing

Otto Insurance offers instant quotes via its website or mobile app, allowing customers to quickly assess potential costs. The company prides itself on transparency, offering clear breakdowns of premium prices, so consumers are never caught off guard by hidden fees or complicated terms.

4. Affordable Rates

As a digital-first company, Otto Insurance eliminates many of the overhead costs associated with traditional insurance providers. This allows the company to offer competitive premiums, often lower than those of conventional insurers. Additionally, Otto offers discounts for bundling multiple policies or for having a clean driving record.

Types of Insurance Offered by Otto

Otto Insurance provides a variety of coverage options designed to meet the needs of both individuals and businesses. Below are some of the key insurance products available:

1. Auto Insurance

Otto Insurance offers comprehensive auto insurance policies, covering everything from liability and collision to uninsured motorist protection. Their digital platform allows you to easily adjust your coverage based on your driving habits, car model, and personal preferences. Additional perks include roadside assistance and rental car coverage.

2. Homeowners Insurance

Otto’s homeowners insurance policies provide protection for your home, personal belongings, and liability coverage. The policies are designed to be flexible, with options to add coverage for things like water damage, earthquakes, or personal injury on your property.

3. Renters Insurance

For renters, Otto offers affordable renters insurance that covers personal property, liability, and living expenses in the event of a disaster. These policies are designed to offer peace of mind for those renting apartments or houses.

4. Life Insurance

Otto also offers life insurance, providing financial protection for your loved ones in the event of your death. With options for term life and whole life policies, Otto gives customers the flexibility to choose the coverage that best suits their needs. More about

5. Business Insurance

For small businesses and entrepreneurs, Otto Insurance provides tailored business insurance policies, including general liability and workers’ compensation coverage. These policies can be customized to fit the unique needs of each business.

Otto Insurance Claims Process

One of the most critical aspects of any insurance company is its claims process. Otto Insurance aims to make this process as seamless as possible. Customers can submit and track claims online through their platform, significantly reducing wait times and paperwork.

Here’s how it works:

- File a Claim Online: Via the website or mobile app, simply fill out a claim form detailing the incident.

- Review and Documentation: Otto Insurance may request additional documentation such as photos or police reports to verify the claim.

- Claims Resolution: Once the claim is processed, Otto will either approve or deny it based on the policy terms. If approved, payment or coverage will be issued.

The company promises fast response times and provides a dedicated claims support team for any questions during the process.

Why Choose Otto Insurance?

1. Innovative Technology

https://ottoinsurance.com/home.htmlOtto Insurance is heavily focused on leveraging technology to provide an effortless and efficient customer experience. From online quotes to a fully digital claims process, Otto’s use of technology ensures that consumers can manage their insurance without unnecessary complications.

2. Affordable Pricing

By operating primarily online, Otto can keep operational costs low, which translates into lower premiums for customers. The company’s transparent pricing model ensures that customers understand what they are paying for and can choose the coverage they need without overspending.

3. Customization

Otto Insurance allows policyholders to fully customize their insurance coverage to fit their specific requirements. Whether you need basic or comprehensive coverage, Otto makes it easy to adjust your policy as your needs change.

4. Customer Support

Despite being a digital-first company, Otto Insurance places a high priority on customer service. The company offers 24/7 support via chat, email, and phone, ensuring that customers can always reach out for assistance when needed.

Final Thoughts

Otto Insurance is an exciting option for anyone looking for modern, convenient, and affordable insurance solutions. With a focus on transparency, customization, and digital innovation, Otto is poised to challenge traditional insurance models and offer a better experience for customers in the digital age.

Whether you’re seeking car insurance, homeowners’ insurance, or any other type of coverage, Otto’s user-friendly platform and competitive rates make it a strong contender in today’s crowded insurance marketplace. As more consumers turn to digital solutions, Otto Insurance is a brand to watch in the coming years.

Otto Insurance: A Simple and Affordable Way to Protect What Matters

Insurance can sometimes feel complicated and overwhelming, especially when you’re trying to figure out which provider offers the best coverage at the right price. Otto Insurance is changing that by offering a straightforward, easy-to-use platform for buying and managing insurance. In this article, we’ll explain what Otto Insurance is, how it works, and why it might be the right choice for you.

What is Otto Insurance?

Otto Insurance is a modern insurance company that uses technology to make getting insurance easier and more affordable. Unlike traditional insurance companies that require in-person meetings or long phone calls, Otto Insurance lets you manage everything online. You can get a quote, buy a policy, and even file claims—all from your computer or phone. This online approach helps Otto keep prices low and provides customers with a simple, hassle-free experience.

Key Features of Otto Insurance

1. Easy-to-Use Website and App

One of the best things about Otto Insurance is its user-friendly online platform. Whether you’re getting a quote or filing a claim, everything is just a few clicks away. You can do everything on Otto’s website or mobile app without having to visit an office or talk to an agent on the phone.

2. Flexible Coverage Options

Otto Insurance offers a range of coverage options that you can customize based on your needs. Whether you’re looking for car insurance, renters insurance, or homeowners insurance, you can easily adjust your policy to get the protection you need without paying for things you don’t.

3. Affordable Prices

Because Otto operates online, it doesn’t have the extra costs that traditional insurance companies have (like maintaining office buildings or hiring lots of staff). This helps Otto offer lower rates than many other insurance companies, making it easier for you to find affordable coverage.

4. Quick and Transparent Quotes

With Otto, getting a quote is fast and easy. You can enter some basic details about yourself and your property, and Otto will instantly show you an estimate of how much your insurance will cost. Otto is also upfront about the pricing, so you won’t have any surprise fees later on.

Types of Insurance Otto Offers

Otto Insurance offers a variety of policies to protect different parts of your life. Here’s a look at the main types of insurance they provide:

1. Car Insurance

Otto’s car insurance policies offer protection in case of accidents, theft, or damage to your vehicle. You can choose from basic coverage or more comprehensive plans that include things like roadside assistance and rental car coverage. The best part is, you can easily adjust your coverage to suit your driving habits.

2. Homeowners Insurance

If you own a home, Otto offers homeowners insurance that covers damage to your property, your belongings, and liability in case someone gets hurt on your property. You can also add extra protection for things like natural disasters, water damage, or theft.

3. Renters Insurance

For people who rent their homes, Otto provides renters insurance. This type of policy covers your personal belongings in case of theft, fire, or damage. It also provides liability coverage if someone gets injured while visiting your home.

4. Life Insurance

Otto offers life insurance policies to help protect your family financially if something happens to you. With life insurance, you can choose how much coverage you need and what type of policy best fits your situation.

5. Business Insurance

Otto also offers business insurance for small business owners. This type of coverage can help protect your business from financial losses due to accidents, property damage, or legal issues.

How to File a Claim with Otto Insurance

If you ever need to make a claim, Otto Insurance makes it simple. Here’s how it works:

- Submit Your Claim Online

You can file a claim directly through Otto’s website or app. Just fill out a form explaining what happened, and upload any necessary photos or documents (like a police report or pictures of damage). - Claim Review

Otto will review your claim to make sure it meets the requirements of your policy. This may include verifying the details of the incident. - Claim Approval

If your claim is approved, Otto will either repair or replace the damaged property, or offer a payout, depending on the type of coverage you have. You can track your claim’s status through the website or app.

Otto strives to make the claims process quick and easy, so you can get back to your life with minimal stress.

Why Choose Otto Insurance?

1. It’s Simple

Otto Insurance is designed to be easy to use. You don’t need to be an insurance expert to get the coverage you need. Everything is done online, and the process is simple to follow from start to finish.

2. Lower Costs

Because Otto doesn’t have physical offices and uses technology to streamline everything, they can offer lower prices than many traditional insurance companies. You can get quality coverage without breaking the bank.

3. Customization

Whether you need car insurance, homeowners insurance, or something else, Otto allows you to customize your policy so you only pay for what you need. This way, you can get the right amount of coverage for your lifestyle.

4. Customer Support When You Need It

Even though Otto is an online company, they provide good customer support. If you have questions or need help with your policy or a claim, you can reach out to their team through chat, email, or phone.

Final Thoughts: Is Otto Insurance Right for You?

Otto Insurance is a great choice if you’re looking for an easy, affordable, and flexible way to manage your insurance needs. Its digital platform makes everything simple, from getting a quote to filing a claim. Plus, their competitive pricing makes it a smart option for those who want quality coverage at a lower cost.

If you want a no-hassle insurance experience that fits your needs, Otto Insurance is definitely worth considering. Whether you’re looking for auto, home, renters, or life insurance, Otto’s easy-to-use platform and customizable plans make it a strong contender in the insurance world.